Secure Your Family’s Future Today...

with Empire Wealth Solutions

Tailored Life Insurance Solutions for Your Diverse Needs

About Us

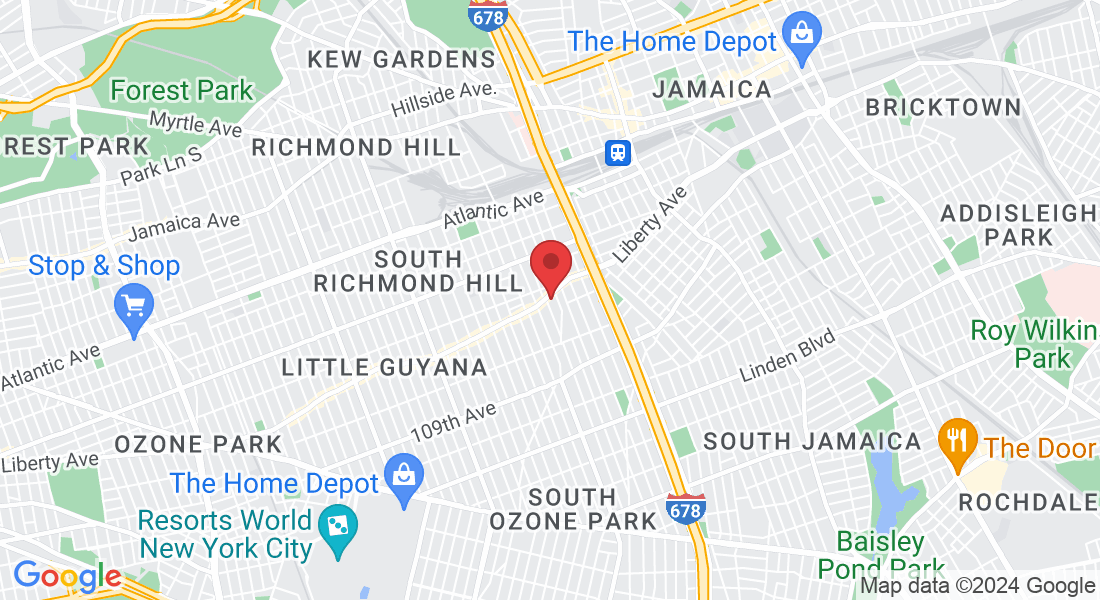

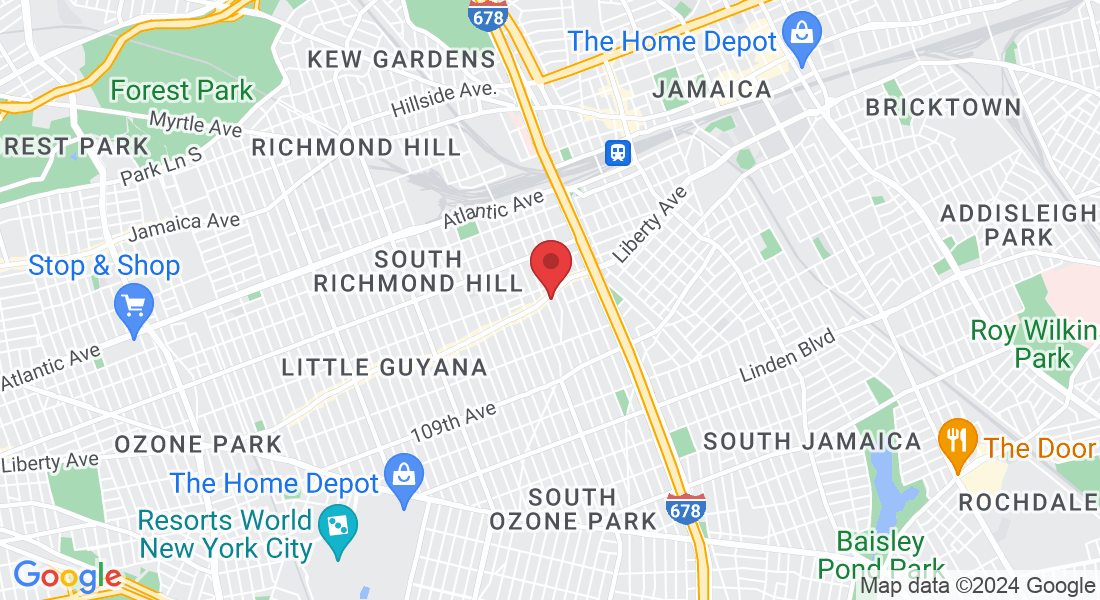

Serving the Community

for over a Decade...

Our implementation of insurance strategies for individuals and families are designed to withstand the test of time. We are focused on providing the best solution for our clients.

Why Choose Us?

Personalized Policies

Regardless of your lifestyle, stage in life or future goal, we help collaborate and develop specific strategies, customizing our team approach around you – aspiring to be your CFO.

Experienced and Reliable

EWS has established itself as a trusted provider of life insurance solutions in Queens, Brooklyn, Bronx, Staten Island, Manhattan, New York and 5 other states.

Comprehensive Coverage

Our Company is committed to provide the finest products and services available on the market-place. We offer products such as Whole life, Term Life, Indexed Universal life (IUL), Variable Universal Life (VUL), Universal Life, Guaranteed Issue(non-medical) and more

Insurances for your

child's future

Tailored Insurance Solutions for Your Child's Bright Future

Get a Free Quote

Unlock Your Peace of Mind:

Get Your Free Life Insurance Quote Today

Our Achievements

Expanded Reach:

Our services now extend to 5+ states, bringing our trusted solutions to more families than ever before.

Growing Clientele:

We proudly serve over 10,000+ clients, a testament to our commitment to excellence and customer satisfaction.

Award-Winning Service:

Our dedication has been recognized with many prestigious awards, highlighting our excellence in service and our commitment to our clients.

5+ States

10k Clients

Award Winning

Meet Our Experts

Our team is led by Kimberly Persaud, Managing Director, whose expertise and leadership ensure that clients receive the best possible advice and solutions. Our agents are not just experts in their field; they're dedicated to making a difference in the lives of the families they serve.

Kimberly Persaud

Managing Director

Kimberly Persaud as the Founder & President of Empire Wealth Solutions LLC drives the energy and efforts of the company. Kim has been the financial advisor to the wealthy and middleclass families in the United States.

Born and raised in Guyana, South America, Kim began her career at Demerara Bank Limited, eventually migrated to the USA where she continued her career in t financial planning, and services industry. Quickly making her mark, she achieved executive council status within six months and garnered numerous awards, including Career Producer, Life Case Rate Leader, New Org.Leader, Centurion Producer, and Million-Dollar Round Table Achiever. As MDRT qualifier, Kim thrives on networking with global financial professionals, continuously enhancing her expertise. Driven by a commitment to excellence and a passion for making a difference, Kim views her clients as family, offering strategies that aim to minimize taxes, create wealth, and establish lasting legacies.

Meet Our Partners

See What Our Customer Say About Us

Natasha Ramnarine

Planning ahead for your financial security? Look no further, Kimberly Persaud of Empire Wealth Solutions will do it for you. She is professional & well verse in all insurance policies. Thank you Kim for taking care of my financial needs with your amazing personality. Excellent work!

Sunil Pandey

Kimberly Persaud, great to work with! has always responded quickly to my questions and concerns. When I’ve had life changes experiences (new car, marriage, new house, etc) she’s been great about getting all what she needs to know about the situation and presents me with insurance options that best meets my needs, and with great rates! I highly recommend – I’ve been with Empire Wealth Solutions for a while and have been very happy with their service! Thanks Kimberly.....Blessings!!

Ashok Barua

For life insurance and more other services Kimberly Persaud from Empire is very friendly, helpful and amazing person. I highly recommend her. I got really good service thank you kimberly

Frequently Asked Question

How can I obtain a life insurance quote from Empire Wealth Solutions?

Getting a life insurance quote from Empire Wealth Solutions is straightforward and convenient. You can request a quote in the following ways:

Online: Visit our website and fill out the quote request form. You'll need to provide some basic information, such as your age, health status, and the amount of coverage you're interested in.

Phone: Call our customer service team directly. Our experienced agents will guide you through the process, answer any questions you may have, and provide you with a personalized quote.

In-Person: Schedule an appointment to meet with one of our agents in person. This allows for a more detailed discussion about your needs and the various policy options available.

What factors influence the cost of my life insurance premium?

Several factors can affect the cost of your life insurance premium, including but not limited to:

1. Age: Generally, the younger you are when you purchase a policy, the lower your premiums will be.

2. Health: Your current health status, medical history, and any pre-existing conditions can impact your premium rates. A medical exam may be required as part of the application process.

Lifestyle: Certain lifestyle choices, such as smoking or engaging in high-risk activities, can increase your premiums.

Coverage Amount: The amount of coverage you choose will directly affect your premium. Higher coverage amounts lead to higher premiums.

Term Length: For term life insurance, the length of the policy can also influence your premium. Longer terms usually mean higher premiums.

Is it possible to adjust my life insurance policy after I've purchased it?

Yes, it is possible to make changes to your life insurance policy after purchase, subject to certain terms and conditions.

Here are a few options that might be available:

Increasing Coverage: You may be able to increase your coverage amount if your insurance needs change, such as after the birth of a child or a significant change in income. This might require additional underwriting.

Decreasing Coverage: If you find that you no longer need as much coverage, you can request to decrease your policy's face value, which may lower your premiums.

Changing Policy Type: In some cases, you might be able to convert a term policy to a whole or universal life policy without undergoing further medical exams.

Adding Riders: Many insurers allow you to add riders to your policy, such as a critical illness rider or a waiver of premium rider, to enhance your covera

Post Address and Mail

Address

131-04 Liberty Ave

S. Richmond Hill, NY 11419